Fed’s Unexpected Rate Cut: Good or Bad? 🎢💸 Imagine this: The Galactic Bank of Eyebrow-Raising Decisions is having its first night, when the Fed strides in looking like Thanos snapping his fingers. Instead of wiping out half the universe, they cut interest rates by 0.25%. Surprise! Your mortgage and credit card APRs can go from “ouch” to “meh” now.

What just happened? 🤔

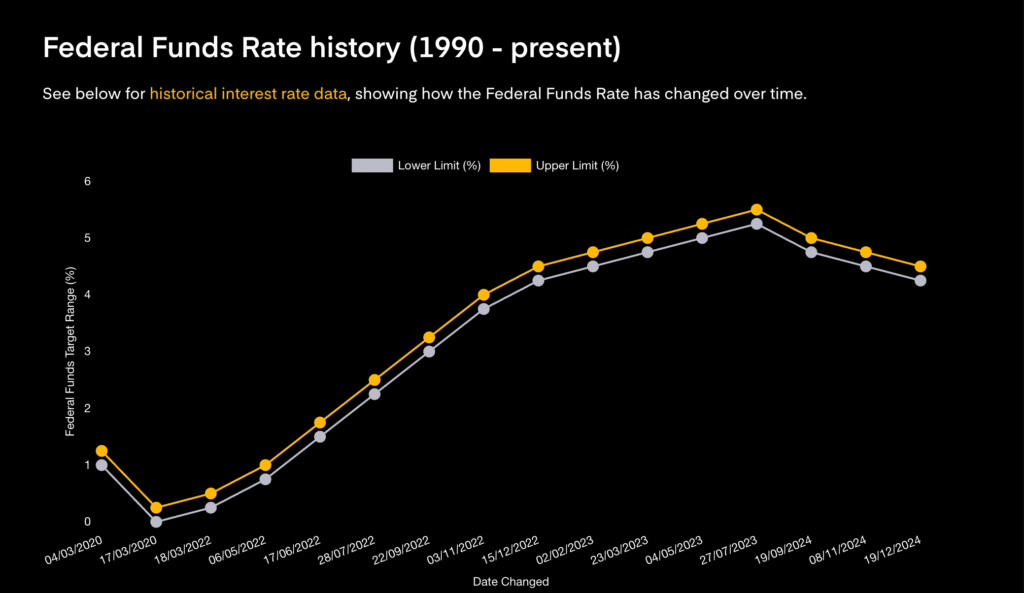

The Federal Reserve lowered its benchmark rate by 25 basis points on August 6, 2025. This was the first time it has done this since 2023. That seems fancy, but here’s how to say it in words that kids can understand:

Before: If you borrow $100, you have to pay $5 more each year (5% rate).

You only have to pay $4.75 more after that (4.75% rate).

Think about it: you borrow 10 gummy bears from a friend. You just owe 0.95 gummy instead of 1 additional gummy as “interest.” Sure, it’s still your gummy, but you get to keep a pinch extra! 🍬😄

Why People Are Using Movie Quotes All the Time

“We’re going to need a bigger boat.” — Jaws (1975)

That’s how banks act. They need to get clients back by offering lower rates. When rates go down, loans grow cheaper, and people ultimately say “Yes!” to new houses, automobiles, and even unicorn-sized business dreams. 🦄🚗🏠

“May the odds always be in your favor.” — The Hunger Games (2012)

Cue the optimistic homeowners looking through “For Sale” signs like they’re lottery tickets. A reduced rate makes it more likely that they will be accepted and able to buy that dream ranch-style house with a backyard big enough for a family of Ewoks. 🌲🌌

The Good Side: Hey, cheap loans! 🙌 Makeover Your Mortgage:

You can save thousands of dollars by refinancing your home loan now. If you could trade your $2,000-a-month mortgage for a $1,950-a-month deal, you could get five more frappuccinos per month! ☕☕☕☕☕

Zen with credit cards:

People with high-interest balances receive a little break. You get closer to 19.75% instead of 20% APR. Your debt still hurts, but at least it’s not as smokey! 🔥👻

Big Hits in Business:

Small businesses can get loans to grow, like turning a taco truck into a taco empire. More money coming in means larger ovens, more workers, and fancier truck wraps.

The Bubble Side: Stop! 🛑

“We have a problem in Houston.” — Apollo 13 (1995)

Just because rates are lower doesn’t mean that economic meteors won’t hit:

Watch for Inflation:

When loans are cheaper, people can spend more, which makes prices go up faster than Godzilla rampaging through Tokyo. If everyone buys now, snacks will cost more tomorrow. 🍿➡️🍿🍿🍿

Savings Drop:

Your piggy bank makes even less. Why keep money at a bank at 1% when loans cost 4.75%? Saving is now as boring as watching paint dry on the Death Star. 🎨🌑

Investor Roller Coaster:

Stocks might go up quickly, but if unmanaged rates rise again (story twist!), your portfolio could please go down faster than Neo dodging gunfire in The Eyes keeps. 🕶️🔫

So, is it a good thing or a bad thing? 🎲

This rate drop is like handing everyone a coupon at the mall. At first, a lot of people come in to shop, but if the coupons never expire or the prices go up, the offers lose their shine. ✨👛

Short-Term Cheer: People who own homes, buy cars, or start businesses are popping champagne tonight! 🍾

Long-Term Warning: If inflation comes back or the Fed raises rates, that happy atmosphere might go away quickly. 🎈➡️💥

What You Should Do in the Last Scene: If you can, refinance. While you can, change the terms of your loan to make them better, much like Luke did with his X-wing.

Spend wisely and don’t buy lightsabers on a whim. Focus on the basics and put money into your future Rebel Alliance.

Save Smartly: Instead of letting cash sit in low-interest accounts, think about putting it in higher-yield accounts or Treasury bonds.

Stay Informed—Watch Fed pronouncements like Sherlock Holmes looks for footprints to figure out what will happen next.

Get ready for some thrilling ups and downs in interest rates! This cut might be your golden ticket or a slippery slope, depending on how smart you are and how much economic Jedi wisdom you have. May your money stay in balance, and may the chances always be in your favor. 🎉💼🌟